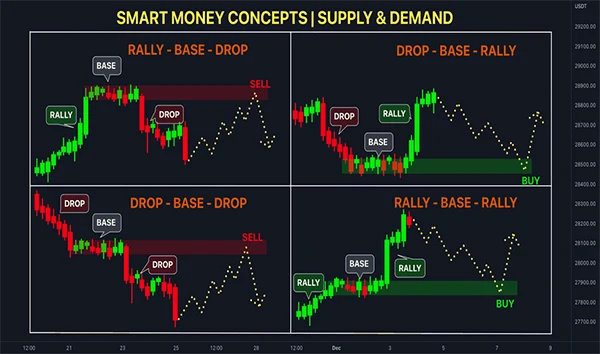

What Are Smart Money Concepts?

The main focus of smart money concepts is how big, institutional actors enter the market. In contrast to retail traders, who frequently act on impulse or by following trends, it is defined by calculated, data-driven decisions.

When it comes to cryptocurrency trading, whales—individuals or organizations that possess substantial cryptocurrency holdings—and professional traders—who have access to more extensive data and resources than the typical retail trader—all exhibit its behaviours.

Well-informed decision-making derived from comprehensive analysis and data is a hallmark of smart money. Because of the enormous sums involved, this kind of investment has considerable power and can change the course of the market. Savvy investors are renowned for their astute timing, meticulously organizing their points of entry and departure to optimize their prospective gains.

So, if you’re also someone looking to grab some substantial gains in the market fluctuations, this read will dive deep into the whole smart money concept, from a proper risk management strategy to even emotional regulation.

Let’s start!

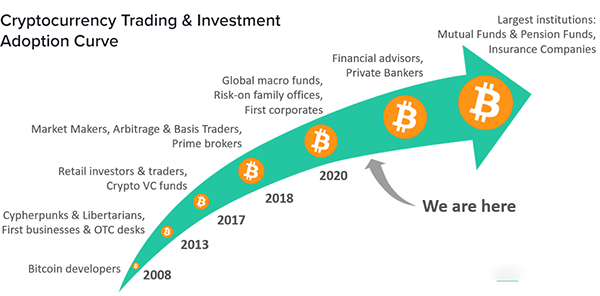

The Function of Institutional Investors in Cryptocurrency Trading

Understanding the role that institutional investors play in the cryptocurrency markets is an integral component of smart money concepts. Institutional investors work on a larger scale than retail traders, investing millions or even billions in cryptocurrencies. These investors use advanced techniques and instruments to reduce risk and increase returns.

They can enter and exit the stock exchange quickly since their trades are typically more rational and based on data and analysis rather than being as emotionally charged. Since institutional investors are usually seeking long-term returns, their actions in the trading space can reveal information about where the values of cryptocurrencies will go in the future.

So, what’s actually the importance of institutional investors:

- The market as a whole may be impacted by their trades, they have considerable liquidity control.

- Their perspective is typically long-term: Short-term volatility has less impact on institutional investors.

- They frequently base their decisions on macroeconomic trends because tracking them can provide insights into future price changes.

Manipulation of the Market and Liquidity

Understanding market manipulation and liquidity are further components of these concepts. Smart money managers frequently exploit the liquidity pockets. Retail traders frequently put stop-loss orders or limit orders in these locations. Frequently, institutions and whales utilize this data to manipulate the market in a way that sets off these orders, causing rapid changes in price.

For example, people may purposefully drive the price down to activate stop-loss orders if a large number of them are placed right below a particular support level. They may then drive the price back up after taking on new holdings.

Here are some useful strategies for smart money:

- Taking use of pockets of liquidity identifying regions in which stop-loss orders are heavily concentrated.

- Making fictitious breakthroughs pushing prices above certain thresholds in an effort to encourage individual buyers and sellers to place bets.

Individual buyers and sellers can better position themselves in the market and avoid falling into institutional players’ traps by being aware of these strategies.

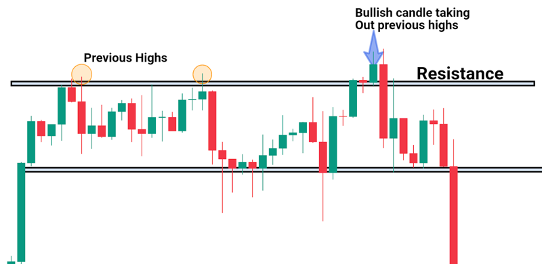

Concepts of Smart Money in Chart Analysis

Technical analysis and chart patterns must be understood in order to trade cryptocurrencies successfully with smart money concepts. To find the best times to enter and exit the market, this employs sophisticated charting tools. These include examining price structures, trend lines, and support and resistance levels that can point to possible manipulation by major participants.

When employing smart money concepts, traders frequently concentrate on the following methods:

- Arrange the blocks: regions where the economy has been penetrated by this, leading to notable price fluctuations. These barriers frequently act as levels of opposition or support in the future.

- Liquidity zones: Areas on the chart where the volatility may be driven by smart money to cause stop losses for retail traders.

- False breakouts that set off retail trades ahead of a price reversal are known as breakout traps.

This can profit from market inefficiencies and anticipate movements that retail traders might miss by using these charting strategies.

Smart Money and Risk Management

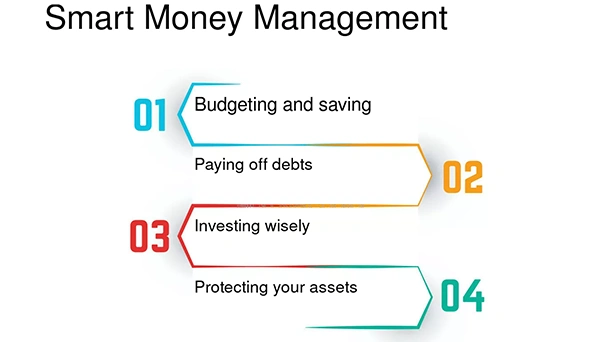

Risk management is one of smart money concepts’ key tenets. Intelligent investors distribute their risk over a number of trades and asset classes rather than investing all of their wealth in a single transaction.

This means that while trading cryptocurrency, you should diversify your holdings over several currencies and tokens and use strategies like stop-loss orders to reduce your potential losses.

Astute techniques for mitigating financial risk:

- Spreading investments among a variety of assets helps lower risk by diversifying them.

- Position sizing: To prevent significant losses, use a tiny portion of total capital in each trade.

- Stop-loss orders are used to ensure that losses are stopped short if a trade doesn’t turn out as planned.

In order to reduce risk and maximize gain, smart money traders are also patient and prepared to wait for the ideal moment to enter or quit a transaction.

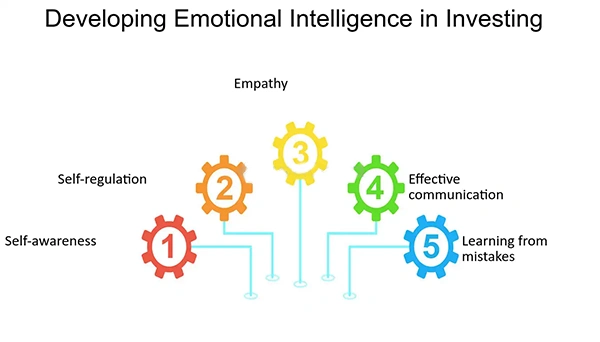

Emotional Regulating in Astute Investment

Emotional control is a key component of smart money concepts. Fear or greed are often the driving forces behind the decisions made by retail buyers and sellers, which can result in bad deals and large losses. Contrarily, disciplined traders adhere to their plans and do not let temporary market swings affect them.

Traders who apply these principles must learn to control their emotions and avoid making rash decisions by depending instead on data and strategic thinking. This strategy could mean the difference between steady profits and large losses in the erratic cryptocurrency space.

Cryptocurrency financiers can navigate the frequently erratic and volatile space with the help of these concepts. Individual can improve their odds of success by mastering advanced chart analysis, identifying liquidity zones, and comprehending how institutional investors function.

Understanding and putting these strategies into practice can be a game-changer for traders who wish to get beyond the novice level. Those who implement these methods will be better able to negotiate the market’s intricacies and seize opportunities as it continues to change.