5 Things to Consider When Buying Car Insurance Online

Buying a car, be it for the first time or multiple times, the excitement remains the same. The insurance paperwork is often completed before you get your new wheels out of the showroom. With automation knocking on the doors of every industry, the respective sector has not lagged.

Now, every consumer is spoiled for choice with online ease and options with the same facilities and policies available through an agent. Car insurance fast online options are possible because of round-the-clock accessibility and AI tools like robo-advisors that aid consumers in filling their applications even at midnight.

Irrespective of the platform, it does not matter if it is online or offline, there are specific details that one has to provide for their paperwork when purchasing a car. Information relating to your driving license, the make, model, and year of the car, vehicle identification number, address, and bank details are required to fill out the forms online.

Well, taking things further, here are some more details worth knowing.

Getting Familiar

The process is similar to offline in terms of compliance and information desirability. Additional points like the safety details of the car, mileage, modifications carried out, etc. are required. These extra details differ between providers. When filling out the application online, it’s noteworthy to have this information ready.

Thanks to advanced AI tools, most information is automatically filled in from your previous data, so you won’t have to retype it multiple times when completing the paperwork.

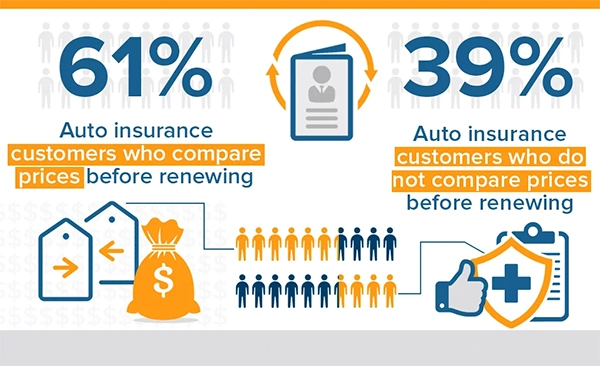

Now that it is iterated that online insurance policy is not any different from offline, let us bust the myth that surrounds online policies that they are not given the same treatment as offline policies during a claim process.

It is not true, as all the providers have both offline and online paths. There are still some auto insurance consumers who are either not tech-savvy or prefer talking to a person before buying a policy.

Who Needs An Auto Insurance?

Everyone who drives and owns a car needs valid insurance coverage. The type of coverage that you need to take will differ from what you want to take. The need for a policy is based on the legal requirements and minimum clauses that vary from state to state.

Interesting Fact

While a majority of vehicles in the USA are insured, there are still around 5-10% of uninsured vehicles.

Liability insurance is the basic minimum requirement one needs to buy for their car as per the compliance clauses of most states. A few states will also need one to get personal injury protection for mishaps they encounter during an accident.

If because of your fault or misjudgment in driving, you damage the property of a third party, then liability insurance covers for the damages. This type of plan is often called third-party auto insurance.

If you are opting to finance your car, then otherwise, optional categories like collision or comprehensive will be required by the financier or the lending institution.

Parameters That Impact The Cost of Insurance

Two people buying the same car’s model and making and opting for the same policy, will not get the same quote. A 30-year-old George from Washington may get a lower quote than a 55-year-old Micheal from Chicago city. This disparity can arise from various reasons, and the most common among them are:

Type of Coverage

Depending on the limit of the coverage you have opted for, the deductibles included, and the limits set, your insurance cost will be higher or lower. Enhanced protections like towing the car during a breakdown will increase the cost of insurance. Except for liability, every other type is optional unless you’re financing your car.

So if you are buying your car outright, and want a minimum requirement policy, then based on the liability insurance you choose, the premiums will be lowest. If you opt for a collision or a comprehensive, then the cost escalates.

If your coverage has more deductibles and limits, then the cost of the coverage for the same policy will be less than a person who does not include more deductibles and limits. A limit is the predetermined maximum coverage agreed in case of an eventuality.

TIP:

Among different types of coverages, some of them are necessary and a few of them are optional. Necessary coverages include:

- Liability Coverage

- Personal Injury Protection

- Optional coverages include:

- Collision coverage

- Comprehensive coverage

- Medical payments coverage

Modifications In The Car

A deductible is the amount you agree to pay before seeking the insurer to start coverage. A policy with more deductibles and limits will be less expensive until there is an accident where your bargain kicks in before your policy starts paying.

If you change the internal car parts that determine the functioning of the car on the road, then the insurance company has to be informed. Usually, modifications to car parts like brakes and suspension, car interiors, or even paint jobs, have to be informed to the provider.

Changing the paint of the car to some catchy and sporty design will make your car look Uber cool. However, these changes are not considered favorably by most providers as they increase the chances of theft of such cool-looking swanky cars.

Whenever there are modifications to a car, there is usually an increase in the premium of the auto insurance.

Motor Habits

Your driving habits determine the cost of the insurance as much as your diligence in keeping the safety certification of your car steadfast. If you drive defensively, then the chances of accidents are minimized, and helps you get a discounted price.

The neighborhood where you live matters to the insurance provider, as most thefts happen in unsafe areas. If you park your car in a designated parking space that is protected with vigilant cameras as against street parking, your insurance will be lower.

Conclusion:

Auto insurance is regular compliance for car owners and is one aspect that impacts our finances and peace of mind tremendously. If you are found driving without insurance, your car will be seized, and your permit may be canceled, even if you have not been detained for an accident. Be a responsible driver and enjoy your wheels when you take those long drives with family and pets by buying appropriate auto insurance through online or offline platforms.