Demystifying Secure Act 2.0 — What You Need to Know About the Latest Retirement Legislation

America has been facing a retirement crisis. As per a Federal Reserve survey — 75% of the non-retirees hardly have any savings whatsoever. On the other hand, only 40% think they are on the right track in retirement savings plans.

To address the issue, Congress attempts to introduce Secure Act 2.0, to secure Americans for their golden years. This version of 2.0 aims at finishing the job begun by the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019. Various people such as part-time workers, retirees, and even small business owners will benefit from this reform.

The law will take effect from 2025. From better catchup contributions to 401(k) enhancements, the updated version introduced several changes. This article provides in-depth details regarding the same, read along to know more.

Better Catch-Up Contributions

Section 127 of Secure Act 2.0 allows employers to offer non-highly compensated employees pension-linked emergency savings accounts. These accounts can hold up to 3% of compensation and make contributions after tax.

In financial emergencies, you can withdraw assets up to $1,000 annually without penalty. Moreover, after reaching the age of 59, half of the assets become exempt from the 10% early withdrawal penalty.

Starting in 2024, Secure Act 2.0 will require catch-up contributions for participants earning over $145,000 to be made on a Roth basis (i.e., after-tax filing). It will change the tax treatment of these contributions and prevent participants from using the extra money to meet the minimum required distributions later in life.

Through this act, it becomes easier for employers to include annuity contracts in their account balance plans. People get a lifetime income stream that would otherwise only be available in traditional defined-benefit pension plans.

DID YOU KNOW?

The SECURE 2.0 Act raised the RMD age from 72 to 73 in 2022, and to 74 in 2029. In 2033, the RMD age will be 75. This allows people to continue growing their retirement accounts longer

No Penalties for Over-Contributions

The original version of the act was a game-changer in many ways, and version 2.0 brings even more changes to the retirement world. One of the significant changes is that small employers can easily sponsor plans, expand automatic enrollment, and let you designate some contributions as Roth.

Plus, it expands catch-up contributions. This is excellent news for those who are behind in their savings. Meaning, individuals can put away extra money in their workplace retirement accounts and IRAs, even though the contribution limits remain the same.

The law also changes the rules surrounding required minimum distributions (RMDs). Starting from 2023, the RMD ages for individuals over 70 1/2 will be raised to 73, which will increase to 75 by 2033. This change aims to promote better financial planning and security among senior citizens.

With such reforms, individuals have more flexibility when taking their RMDs and may lower their tax bills. However, it’s necessary to understand the trade-offs involved when delaying RMDs.

401(k) Auto-Enrollment

Serial job hoppers may advance their careers more rapidly than those who remain at one employer for decades. However, those frequent changes can create headaches regarding retirement savings. For starters, they often face constantly rolling over 401(k) funds between jobs.

The new legislation requires companies to establish recent 401(k) plans to enroll workers automatically when they become eligible. The first-time contribution level would start at 3% and increase by 1% each year, up to 10% of compensation (or 15% if the employee affirmatively chooses to contribute more).

Along with that, as per law, employers who auto-enroll workers to pick default investment options, typically target-date funds appropriate for their current age and expected retirement date.

It is meant to overcome research suggesting that many workers neglect to change their default selections. Plus, non-highly paid employees can make after-tax Roth catch-up contributions to 401(k)s and 403bs.

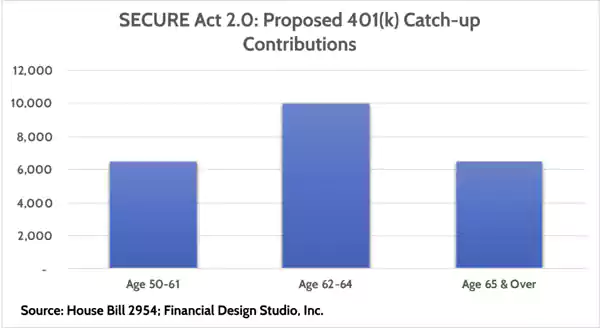

The following graph represents 401(k) catch-up contributions by different age groups.

Military Spouses’ Retirement Savings

A pivotal part of the Secure Act 2.0 is a requirement for employers to auto-enroll employees in their company-sponsored 401(k) plan. It is an excellent step in the right direction because far too many Americans need to take advantage of their company retirement savings plans, and auto-enrollment is one way to help.

The recent legislation also allows people who move between jobs to keep their 401(k) account balances. Frequent job changes can make it challenging to manage the accounts. However, making this vital change can help to track and manage the savings effectively.

However, this isn’t all good news because it allows better flexibility in delaying Required Minimum Distributions (RMD). It may help you save more by not having to withdraw until later, but remember that the longer you wait for your RMDs, the larger they will need to be. As a result, it can significantly affect the long-term tax bill.

Long-Term Care Insurance Penalties

Long-term care costs can be financially devastating, and individuals need to save as much money as possible for this risk. The law allows retirement plan participants to withdraw up to $2,500 annually from their tax-preferred accounts to purchase long-term care insurance policies without penalty.

With the latest Secure 2.0, employers can offer various annuity options without restrictions. It is a welcome change from the previous actuarial test that prevented life annuities from being provided in account balance plans or IRAs.

Through this update, people can plan their retirement and handle their finances effectively, securely, and sustainably, which will help them achieve excellent financial stability and independence.

The law also allows small-denomination gift cards to be used as de minimis financial incentives for employee participation in the workplace plan, subject to certain limits. It is an efficient way to encourage personnel to save and help them reach their savings goals.

Another aspect of the bill is removing a requirement for employers to match contributions to the workplace plan for those earning up to $15,000. This change will enable Americans to save and retire on time.

DID YOU KNOW?

The SECURE 2.0 Act mandates auto-enrollment for new plans. After the first year, the automatic enrollment rate must increase by 1% each year up to at least 10% but not more than 15%.

Error-Fixing Power

After months of speculation, Secure 2.0 made it over the finish line when Congress added it to the 2023 Consolidated Appropriations Act funding bill, and President Biden signed it into law. The final version of the new legislation contains a broad swath of retirement plan enhancements, including many that will impact employer-sponsored plans.

One new feature is a searchable database to help individuals find missing 401(k) and other savings, which account for millions of dollars in lost assets annually. This feature is intended to improve the current process, which can be time-consuming and frustrating.

Are you looking to establish a unique simplified employee pension (SEP), Savings Incentive Match Plan for Employees of Small Employers (SIMPLE), or a qualified plan like a 401(k)? You’ll be happy to know that the recent legislation under Section 102 has enhanced and expanded the startup tax credit, making it easier for small employers to take advantage of it.

It is great news for those looking to provide their employees with a reliable plan when saving on taxes at the same time. This step will encourage more small businesses to offer retirement benefits to their workers and help them save for their future.

The law also reduces the RMD penalty for IRA owners over 70 but under 74 and 77, reducing the penalty to 25% from 50%.

Suggested Read: ATT My Results: Login Guide to AT&T Sales Dashboard HR Access

Final Input

Retirement plans are meant to protect individuals from any financial issues and to give them security in the future. That is why Secure Act 2.0 introduced, intends to help millions of Americans to save for their retirement. It is an updated version of the 2019 SECURE Act.

A lot of changes and additions have been made in the 2.0 update. We tried to cover everything related to the latest changes, such as no penalty for catchup contributions, long-term care insurance penalties, and so on. Hope this helps!